In a world where technological advancements continue to revolutionize the way we conduct business, the threat landscape facing financial institutions is evolving at an unprecedented pace. The recent incident reported by CNN, where a finance worker fell victim to a deepfake scam, serves as a stark reminder of the critical importance of bolstering security measures to combat emerging threats effectively.

The incident, which saw fraudsters utilizing deepfake technology to impersonate a company's chief financial officer in a video conference call, resulted in a staggering loss of $25 million. This elaborated scheme highlights the sophisticated tactics employed by cybercriminals to exploit vulnerabilities in traditional security protocols, emphasizing the urgent need for banks to adopt robust countermeasures.

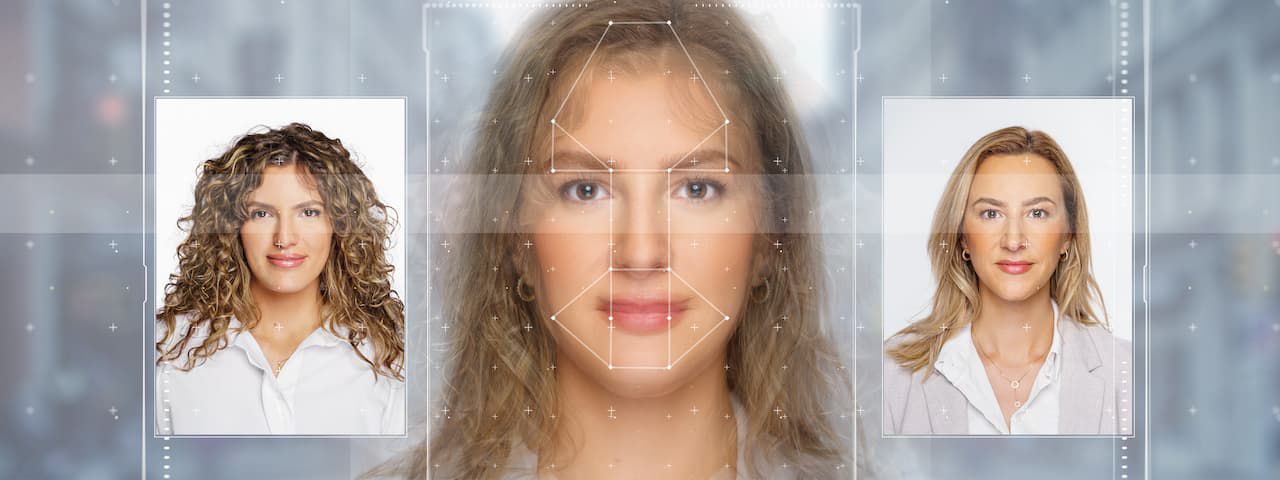

At the forefront of this battle against deepfake, fraud is the imperative for financial institutions to fortify their biometric security systems. Biometric authentication, which relies on unique physiological characteristics such as facial features or fingerprints, has long been touted as a more secure alternative to traditional password-based methods. However, as demonstrated in the aforementioned incident, biometric systems are not immune to manipulation, particularly in the face of rapidly advancing deepfake technology.

To address this challenge head-on, banks must leverage cutting-edge solutions that incorporate advanced deepfake detection algorithms. These algorithms, powered by artificial intelligence and machine learning, are designed to analyze video and audio streams in real-time, enabling the identification of anomalies indicative of deepfake manipulation. By implementing such technologies, financial institutions can significantly enhance their ability to prevent fraudulent attempts and safeguard their assets against malicious actors.

Furthermore, the integration of presentation attack detection (PAD) techniques is paramount in ensuring the integrity of biometric authentication processes. PAD solutions are specifically designed to detect and prevent spoofing attempts by analyzing the quality and authenticity of biometric samples. Through the deployment of robust PAD mechanisms, banks can effectively mitigate the risk of unauthorized access and protect their customers' sensitive information from exploitation.

In addition to bolstering security measures, it is essential for banks to prioritize user experience (UX) and inclusivity in the deployment of biometric authentication systems. By conducting comprehensive bias detection evaluations, financial institutions can identify and rectify any inherent biases within their algorithms, thereby ensuring fair and equitable treatment across diverse user demographics. Moreover, the implementation of clear segregation of duties between transaction creators and validators serves to enhance accountability and mitigate the risk of insider threats.

At Fime, we understand the complex challenges facing banks in safeguarding against deepfake fraud and other emerging threats. With our expertise in biometric security and deepfake detection, we are committed to empowering financial institutions with cutting-edge solutions tailored to their specific needs. Through strategic advisory services and innovative technology offerings, we enable banks to stay ahead of the curve and protect their assets with confidence.

In conclusion, the incident reported by CNN underscores the critical importance of strengthening bank security against deepfake fraud in today's digital landscape. By embracing advanced biometric authentication solution and evaluating in advance the detection of presentation or injection attacks, financial institutions can fortify their defenses and mitigate the risks posed by sophisticated cyber threats. User experience, inclusivity and trust on biometric systems are key for user adoption. Together, we can navigate the challenges of the digital age and build a more secure future for banking.

For any assistance, contact us at sales@fime.com.

To learn more, read the following blog: