With global digital payments set to hit a record $4.7 trillion transaction value this year, this market is showing no signs of slowing down. Simple to set-up and low cost, SoftPOS solutions are perfect for small and medium merchants looking to capitalize on the digital commerce trend.

Our customer Synthesis was keen to launch a SoftPOS solution to address demand for contactless payments in Africa. Synthesis is a specialized software development company that offers solutions and services to many of Africa's largest banks and financial institutions.

In this Q&A, we speak to Pierre Aurel, Product Manager at Synthesis, to learn more about how Fime supported them to achieve the first automated Mastercard TEI accreditation for a new SoftPOS solution.s.

Q: Firstly, what are SoftPOS solutions?

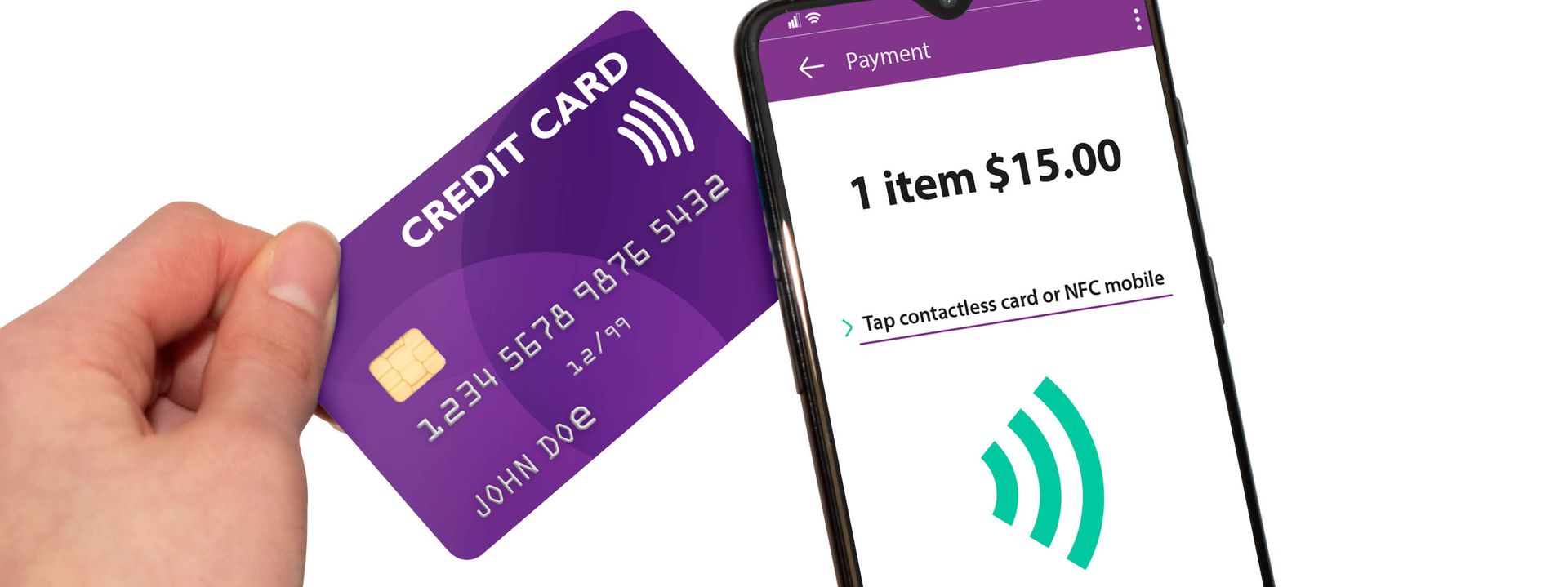

Pierre Aurel: SoftPOS apps offer a simple and cost-effective way for merchants to accept payments and a seamless experience for customers. Consumers simply tap their contactless card, mobile device, or wearable against the acceptance device to make a payment up to a certain value, with no PIN entry necessary. As a result, these apps are also commonly known as Tap on Phone or Tap to Phone.

SoftPOS solutions use the near-field communication (NFC) functionality of a commercial off-the-shelf mobile device, for example a tablet or a smartphone. They are completely software-based, which means they do not require any additional expensive hardware, such as a terminal or PIN pad.

Fime’s previous experience of SoftPOS projects in India, Malaysia, Thailand and the UAE stood out, showing us the team knew how to drive successful certifications.

Pierre Aurel

Product manager at SynthesisQ: What are the benefits for the market?

PA: SoftPOS solutions allow small merchants and sole traders to accept digital payments in a cheap and simple way, driving digitalization, financial inclusion and boosting their offering for consumers.

These solutions are growing in popularity, especially in a time when safer and more hygienic payment methods are essential. The number of contactless cards issued is expected to rise above two billion in 2020 due to the Covid-19 pandemic. Likewise, wearables and mobile wallets are also experiencing strong growth, so it is important for us to keep up with increasing consumer demand for new and seamless payment methods.

Q: What were Synthesis’ requirements for its solution

PA: We needed to test and validate the functionality of our Tap on Phone solution in line with the Mastercard Test Environment Interface (TEI) L2 requirements.

This is a fast-moving market so we wanted to do everything possible to ensure a smooth process. We needed expert support to guide us through the complexities of certification. Automated testing was key to speed up the process to save time and money, and reduce manual error. This was important to us as we wanted to ensure that our solution was high-quality and could be trusted to handle sensitive cardholder data.

Outside of the testing itself, we were under pressure to meet deadlines so needed a partner that had expertise in SoftPOS innovation to help us fast-track compliance.

Q: Why did Synthesis choose Fime for this project?

PA: We were looking for a partner with a reputation for innovation. A partner that puts us at the forefront of payments technology. A partner with a good understanding of the technologies, business models and market to help us navigate certification challenges. Fime’s previous experience of SoftPOS projects in India, Malaysia, Thailand and the UAE stood out, showing us the team knew how to drive successful certifications.

Fime’s knowledge of the Mastercard requirements and previous experience with coordinating TEI compliance were also vital, as they had the expertise and agility to guide us through the certification process, step-by-step.

Q: What was Fime able to deliver?

PA: Fime provided us with tailored consultancy, helping us to achieve the very first automated Mastercard TEI SoftPOS compliance. This solidifies our position as a market-leading solution provider.

Remarkably, Fime’s experts developed a new tool specifically to test this project, requiring significant expertise as well as an in-depth understanding of our product. In rising to this challenge, the team ensured that our brand-new product aligned with the existing standards for POS terminals.

Fime’s efficient work enabled us to bring our SoftPOS product to market quickly, cost-effectively and safely. We look forward to working together in the future to ensure that we keep meeting the demand for innovative payment solutions, supporting merchants and driving financial inclusion.

To learn more about how Fime is supporting the deployment of SoftPOS solutions, watch our webinar.