As the world becomes more digital, the way we interact, authenticate ourselves, and make payments is evolving. Digital identity now sits at the heart of this transformation, offering a faster, more secure way to verify who we are in the online world. Whether you're shopping online, logging into your bank account, or accessing government services, your digital identity can easily connect you to the services you need.

This powerful innovation is shaping the future of secure online transactions, making it easier for individuals and businesses to operate in a digital-first world. But what exactly is digital identity, and how is it impacting the payments industry?

Introduction to Digital Identity.

Digital identity is a virtual representation of you. It includes official personal information, such as your name, date of birth, and even government-issued credentials such as a national ID or driver’s license. This data is securely stored and used to verify your identity whenever needed, allowing you to access services and authenticate yourself, all without needing to show a physical document.

In the payments industry, digital identity services would play a significant role. By providing a secure and convenient way to prove identity it would reinforce the onboarding process (such as bank account creation or payment method enrolment), support strong customer authentication and reduce fraud surface (such as friendly fraud and account take over).

How does it work?

The payment sector, identified as strategic, has high expectations for digital identity, which enables new payment use cases and integrate multiple layers of technology.

Adding digitized payment attributes:

Enrolment: A government-authorized entity can issue an attribute attestation – known as Qualified Electronic Attribute Attestation (QEAA) - directly to your digital identity wallet. For example, a government agency could digitize your passport. In the payment context, a bank can provide proof of banking account, or a card ownership.

Verification: You simply select a digital attribute to share with a relying party to access their services. For example, a car rental company might need proof of your driver’s license. In payments, it could be payment credential verification as part of a strong customer authentication.Authenticating payments: The digital identity wallet is ideal to comply with the strong customer authentication regulatory obligations by linking a user’s identity to a payment instrument or account. In such a scenario, the DI wallet can be activated by a merchant during an e/mcommerce flow to capture authentication data for payment authorization; alternatively, the payer’s bank can use the DI wallet to authenticate the payment during checkout.

A major advantage is the DI wallet is its ability to share other user attributes with the relying party depending on the requested services or goods (such as age verification).

To enable payment authentication, the user must first register their DI wallet to their bank. Once registered, a payment attribute is added to the wallet, illustrating a potential payment authentication flow that involves multiple technology layers.

Illustrative only.

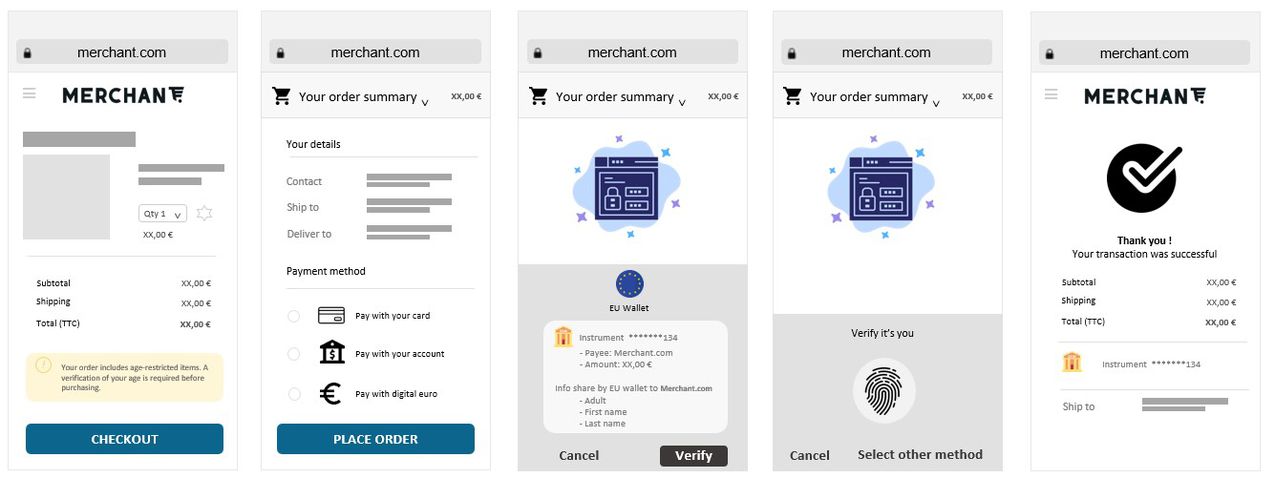

Starting a payment: The user selects his favorite payment method and places the order.

Digital identity wallet: The payment system automatically retrieves verified identity details from a secure digital identity wallet.

Biometric authentication: To comply with security regulations, the user confirms their identity using biometrics, such as a fingerprint.

Transaction complete: The payment is processed securely, with the user's identity verified in seconds.

Initiating payment: The digital identity wallet would offer additional payment services beyond a strong customer authentication. Integrated into payment infrastructure, some emerging solutions propose instant payment initiation and payment request. For instance, a merchant could request a payment from your wallet through qrcode, push notification of deep linking. This action would trigger a strong customer authentication and a payment initiation such as instant payment fund transfer. Card payment is also considered leveraging on tokenisation and digitization process. In such scenario the digital identity wallet is extended to a payment wallet enabling NFC, in-app and ecommerce transaction.

Starting a payment: The user selects his favorite payment method and places the order.

Digital identity wallet: The payment system automatically retrieves verified identity details from a secure digital identity wallet.

Biometric authentication: To comply with security regulations, the user confirms their identity using biometrics, such as a fingerprint.

Transaction complete: The payment is processed securely, with the user's identity verified in seconds.

Initiating payment: The digital identity wallet would offer additional payment services beyond a strong customer authentication. Integrated into payment infrastructure, some emerging solutions propose instant payment initiation and payment request. For instance, a merchant could request a payment from your wallet through qrcode, push notification of deep linking. This action would trigger a strong customer authentication and a payment initiation such as instant payment fund transfer. Card payment is also considered leveraging on tokenisation and digitization process. In such scenario the digital identity wallet is extended to a payment wallet enabling NFC, in-app and ecommerce transaction.

Digital identity creates a frictionless and secure process, benefiting both businesses and consumers, but what about the regulation behind it?

Introduction of the regulation behind Digital Identity.

While digital identity is transforming payments, the framework that ensures its security and interoperability is equally important. That’s where Electronic IDentification, Authentication And trust Services (eIDAS 2.0) regulation comes into play.

eIDAS 2 is a set of rules created by the European Union to ensure that digital identities can be used safely and reliably across all EU countries. Its main goal is to create a standardized and secure way for people and businesses to use their digital identities, whether they’re logging into online services, accessing government portals, or making payments.

This regulation creates a system where people can use their digital identities confidently, knowing their data is secure and recognized everywhere in Europe. For payments, it simplifies verification, reduces fraud risks, and ensures transactions meet high- security standards, benefiting both consumers and businesses.

Looking ahead: Digital Identity and the Digital Euro

One of the most exciting opportunities on the horizon is the digital euro, an electronic form of the euro currently being developed by the European Central Bank to offer a digital alternative to cash for everyday transactions across the eurozone. While these two initiatives are currently separate, they share the goal of creating a secure, interoperable digital financial infrastructure in Europe. Digital identity wallets enable cross-border payments by being accepted and trusted across various European countries, further enhancing the reach and usability of such digital solutions.

In the future, European digital identity wallets could be used to authenticate transactions involving the digital euro, offering a more secure and efficient way to handle digital currency. While this is still speculative, Fime is closely monitoring these developments and is actively involved in key industry payment working groups to shape and support this evolution.

Conclusion.

By adopting digital identity solutions, businesses can gain a competitive edge, simplify their operations, and build stronger relationships with customers.

Digital identity service for payment achieve two main goals: first, enhancing customer experience by reducing friction in transactions, and second, increasing security and privacy to combat fraud risks such as scams, phishing, friendly fraud, and account takeovers. With instant, secure, and convenient identity verification, customers feel confident that their data is protected, reducing cart abandonment, building trust, and fostering long-term loyalty.

Undoubtedly, the digital identity wallet will become a pivotal part of our daily activities, reshaping how we manage payments and interact online. While our exploration has focused on the European Union's progress and regulatory framework, it serves primarily as an illustrative case. Similar digital identity advancements are unfolding across the globe, although information on some regions is less publicly available. At Fime, we remain deeply engaged and informed about these developments worldwide, contributing to the ongoing evolution of secure and efficient payment systems.

Saad

Ait Mansour

Junior Payment Consultant

Fime